ASP Isotopes

$5.21 +0.2950 +1.07% 932.9K

A leader in isotope enrichment technology for the medical, green energy and industrial sectors

Company Overview

ASP Isotopes is an advanced materials company dedicated to the development of technology and processes to produce isotopes for use in multiple industries. The Company employs proprietary technology, the Aerodynamic Separation Process, to produce and commercialize highly enriched isotopes for the healthcare and technology industries. The Company also plans to enrich isotopes for the nuclear energy sector using Quantum Enrichment technology that the Company is developing.

Value Proposition

ASP Isotopes is at the forefront of advanced isotope production, leveraging over two decades of R&D to deliver groundbreaking solutions across nuclear medicine, green nuclear energy, and quantum computing. With a proprietary Aerodynamic Separation Process (ASP) and the novel Quantum Enrichment technology, ASP Isotopes is uniquely positioned to capture expanding markets driven by urgent global needs for advanced isotopes.

ASP Isotopes signed a term sheet with TerraPower, a Bill Gates-founded company, to construct a High Assay Low Enriched Uranium (HALEU) production facility. This facility will support TerraPower’s advanced nuclear energy initiatives, marking a significant validation of ASP Isotopes’ capabilities by a globally recognized leader in nuclear innovation. Under the terms of the agreement, TerraPower has committed to funding construction and entering a 10-year supply agreement, positioning ASP Isotopes as a pivotal player in the HALEU supply chain for next-generation reactors.

ASP Isotopes has achieved a key milestone with the early production of enriched Ytterbium-176, a critical component for emerging oncology treatments like Lutetium-177, which is forecasted to become a multi-billion-dollar market. This development demonstrates ASP Isotopes' technological edge and readiness to address shortages in life-saving radiopharmaceuticals.

As ASP Isotopes advances its operations, the Company has plans for additional Quantum Enrichment plants dedicated to Nickel- 64 and Lithium-6/7 production. These isotopes are essential for medical imaging, advanced nuclear reactors, and anticipated nuclear fusion applications, making ASP Isotopes a strategic supplier in the fast-evolving nuclear and healthcare markets.

With a robust financial position, free from long-term debt and bolstered by non-dilutive funding channels through strategic partnerships like TerraPower, ASP Isotopes is positioned to become a leader in both low and high atomic mass isotopes by 2028. This strong outlook, combined with strategic expansions and innovative operational strategies, underscores ASP Isotopes' potential for sustained growth and value creation for its shareholders.

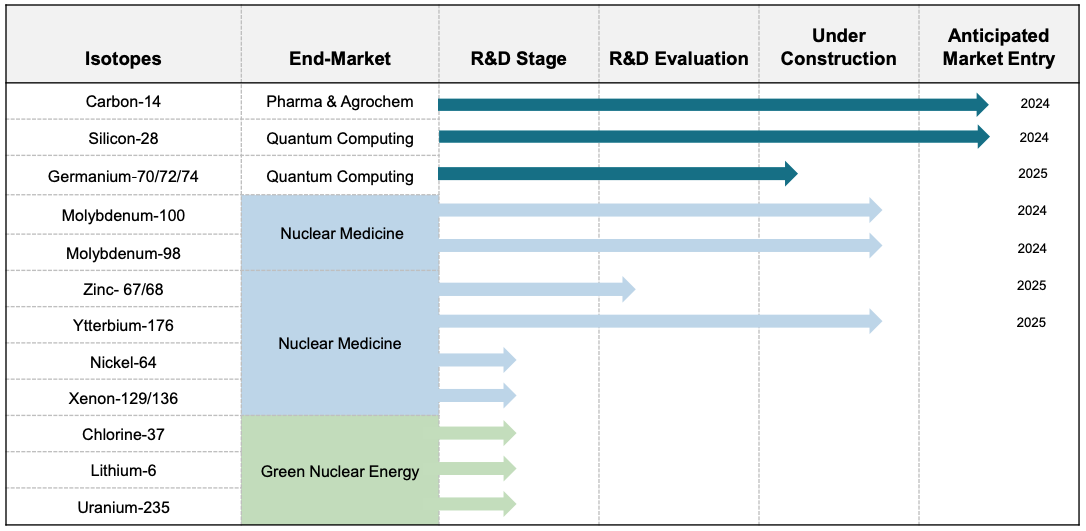

Development Pipeline

Medical

Semiconductors

Investor Presentation

Investment Highlights

Game-changing strategic partnerships and revenue-driving agreements

- Secured a transformative term sheet with TerraPower, a pioneering nuclear company founded by Bill Gates, to develop a cutting-edge HALEU production facility

- Under the terms of the agreement, TerraPower will fund the project and commit to a 10-year supply agreement

- Alliance validates ASP Isotopes' technology on a global stage, setting the company up as a crucial partner in the clean energy revolution

- Long-term $27 million annual contract with BRICEM to deliver Mo-100, supporting critical medical applications

- Multi-year supply agreement for highly enriched Carbon-14 with RC-14 in Canada, targeting $3.8 million per year, with an optional 10-year extension

- $9 million contract with a major S. customer for a highly enriched isotope

Advanced enrichment facilities - low capital cost and environmentally friendly

- Completed Ytterbium-176 facility nine months ahead of schedule and already producing enriched isotopes, targeting 75% purity levels to meet growing demand for Lutetium- 177-based oncology treatments; positioned to address global supply shortages in critical cancer therapies, with a market expected to exceed $15 billion annually within the next decade

- New Quantum Enrichment plants for Nickel-64 and Lithium-6/7 are underway, addressing critical applications in medical imaging, advanced reactors, and nuclear fusion

Disruptive technology –the future of isotope production

- Proprietary Aerodynamic Separation Process (ASP) enables low-cost, scalable enrichment with zero waste, making it a cleaner alternative to traditional methods

- ASP facilities use modular designs, enabling fast capacity expansions to meet surging demand in healthcare, quantum computing, and green energy

- Cutting-edge Quantum Enrichment technology slashes capital costs and time-to-market compared to conventional centrifuge processes

- Expected to provide “green energy cost advantages,” delivering HALEU and other isotopes at competitive prices to support climate-friendly energy solutions

Massive market demand and growing global need for stable isotope supply

- Positioned as a reliable Western supplier with strategically located facilities in South Africa to serve global needs, mitigating supply risks and reducing dependency on foreign sources

- With older research reactors phasing out and traditional suppliers from Russia and China facing trade limitations, ASP Isotopes offers a trusted alternative

Highly experienced leadership team

- Paul Mann, Co-Founder, Chairman, CEO, CFO; 20+ years’ experience on Wall Street investing in healthcare and chemicals companies, having worked at Soros Fund Management, Highbridge Capital Management and Morgan Stanley; began career as a research scientist at Proctor & Gamble

- Hendrik Strydom, PhD, Director, CTO; 30+ years’ experience in isotope enrichment; co- developed isotope separation technology that is backbone of ASP Isotopes

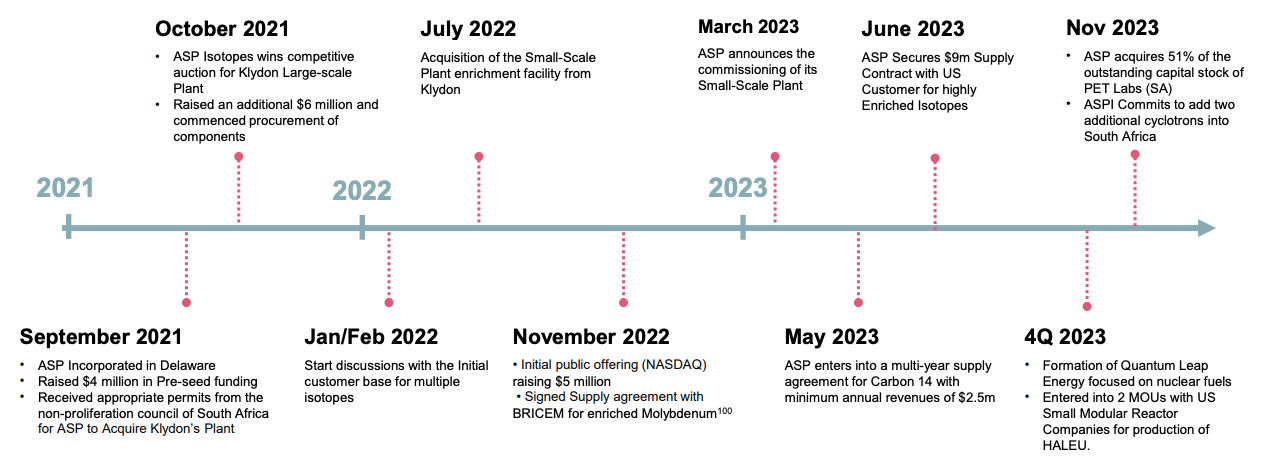

Rapidly Advancing Operations

Sign Up For ASPI Email News Alerts

Disclosure

RedChip Companies, Inc. research reports, company profiles, and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that RedChip Companies Inc. is an investor relations firm hired by certain companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles, or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca.

ASP Isotopes (ASPI) agreed to pay RedChip Companies, Inc., a $12,500 monthly cash fee and $50,000 of Rule 144 stock, deemed earned immediately after the IPO, beginning in August 2022, for 12 months of RedChip investor awareness services. ASPI also agreed to pay RedChip a $50,000 fee for a national TV ad campaign aired May 10 to May 24, 2024. As of September 2024, RedChip’s shares of ASPI are unrestricted and RedChip intends to sell all of its shares immediately and you may be buying as RedChip is selling. As of November 1, 2024, RedChip has sold all of its ASPI shares.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.