Enlivex Therapeutics Ltd.

$1.11

+0.0300 (-0.39%)

Company Overview Listen to Overview

Enlivex is a clinical stage macrophage reprogramming immunotherapy company developing AllocetraTM, a universal, off-the-shelf cell therapy designed to reprogram macrophages, which are primary immune cells, into their homeostatic state. Diseases such as osteoarthritis, sepsis, and many others reprogram macrophages out of their homeostatic state. These non-homeostatic macrophages contribute significantly to the severity of the respective diseases. By restoring macrophage homeostasis, Allocetra™ has the potential to provide a novel immunotherapeutic mechanism of action and resolution for conditions which are life-threatening and debilitating “unmet medical needs”.

Value Proposition Listen to Value Proposition

Enlivex presents a compelling investment opportunity in the biopharmaceutical sector with its innovative approach to treating life-threatening and debilitating conditions through macrophage reprogramming. The company's leading product Allocetra™ is a groundbreaking off-the-shelf, cost-effective cell therapy platform designed to reset the body's immune cells (macrophages) to their optimal functioning state. This technology addresses a critical need for rebalancing the immune system, offering potential treatments for a range of inflammatory and autoimmune diseases with high unmet medical needs. With macrophages playing a vital role as the body's first line of defense, Enlivex's focus on converting these cells from a "disease setting" back to their "resolution settings" opens the door to addressing complex conditions like osteoarthritis and sepsis, tapping into multi-billion-dollar markets.

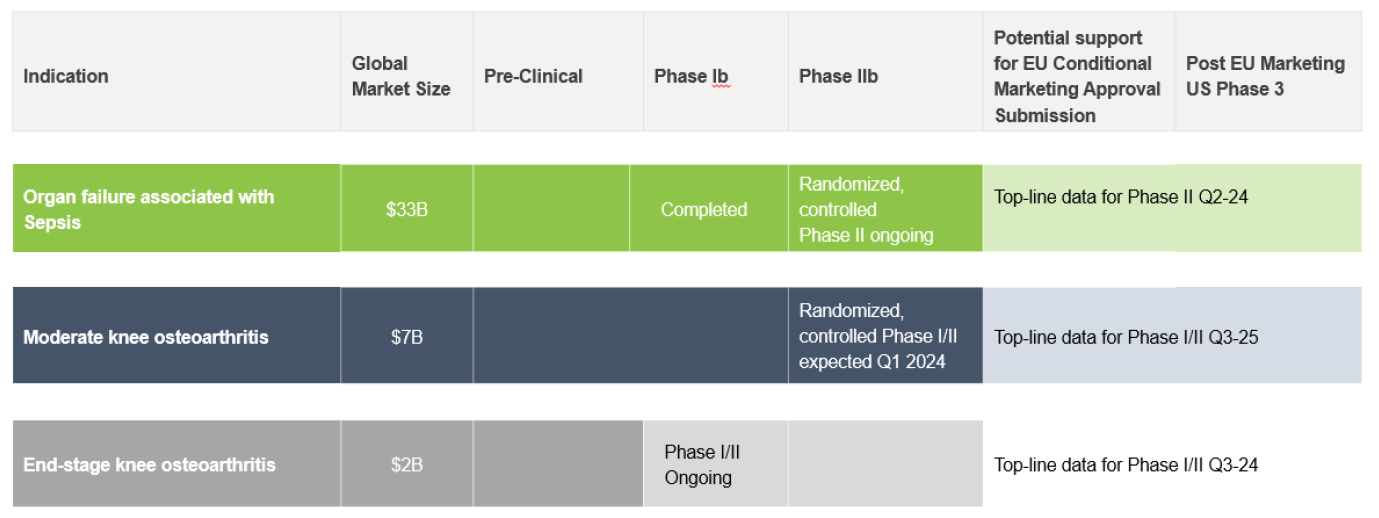

The company is at an advanced clinical stage with Phase I/II trials in osteoarthritis aiming at a combined market opportunity of $9 billion and a Phase IIb trial for sepsis showing promise for a $33 billion market opportunity. Enlivex's strong leadership team, proven by their successful $560 million exit event with PROLOR Biotech and a significant partnership with Pfizer, underscores the company's potential for high returns. With a robust cash balance ensuring an operational runway through the end of 2026 and buy recommendations with a $9.50 per share median price target, Enlivex stands out as a promising investment for investors seeking to capitalize on the next wave of innovations in immunotherapy and cell reprogramming technologies.

Pipeline

Investor Presentation

Investment Highlights Listen to Investment Highlights

Macrophage reprogramming targeting unmet medical need indications

- Off-the-shelf, universal cell therapy for resetting macrophages back to their ”resolution settings” and away from “disease settings”

- A type of immune cell, macrophages act as the body's first line of defense, engulfing and destroying pathogens and debris

- Resetting non-homeostatic macrophages into their homeostatic state is critical for immune system rebalancing and resolution of life-threatening conditions

Advanced clinical-stage pipeline addressing multi-billion-dollar markets

- Phase I/II in osteoarthritis (OA)

- Positive interim readouts for Phase I/II end-stage knee osteoarthritis showed a significant reduction in pain and a favorable safety profile.

- Top-line data for end-stage knee osteoarthritis expected in Q1 2025; $2B global market opportunity

- Top-line data from moderate knee osteoarthritis expected in Q3 2025; $7B global market opportunity

- Phase I/II trial for basal thumb joint osteoarthritis ongoing; early-stage safety run-in and randomized stages planned. Topline data expected in Q2 2025

- Phase IIb macrophage reprogramming for sepsis

- Topline 28 days - potential indication of relative efficacy demonstrated in a population of high-risk UTI patients; ~$10B global market opportunity

- Phase I trial in psoriatic arthritis; initiation authorized in July 2024

- Assessing change from baseline in pain and other parameters of disease activity for up to 12 months; ~$10.8B global market in 2023, growing to $20.5B by 2032

Strong leadership

- Previously founded and managed PROLOR Biotech; a $560M exit event; signed partnership with Pfizer, including $295 million down payment; and drug (NGenla) approved in 43 countries (incl. US); leading product in $4 billion market

- Vice Chairman Roger Pomerantz: former Head of Business Development at Merck and former Venture Parter at Flagship Pioneering

Cash balance supporting multiple clinical milestones within 18-24 months

- $9 million cash (as of June. 30, 2024) provides runway through year end 2026

Buy recommendations from H.C. Wainwright & EF Hutton with median $9.50 per share price target

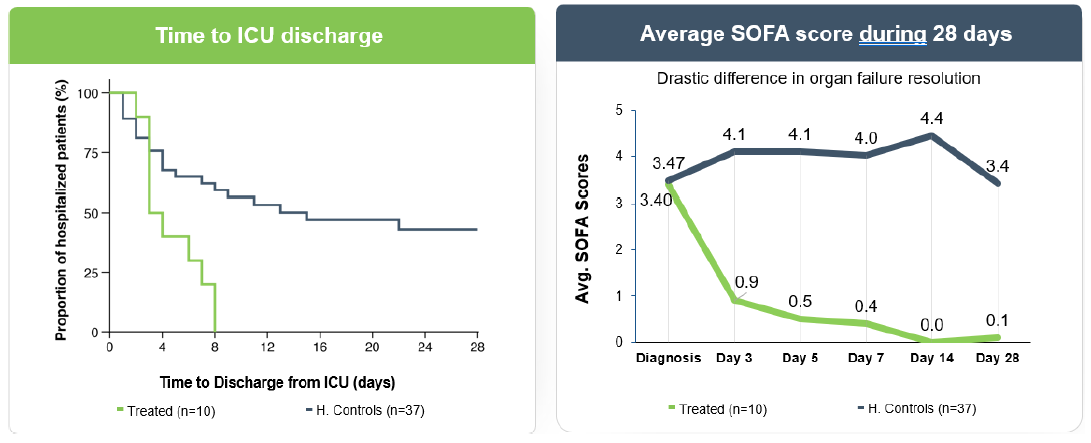

Allocetra™ Compassionate Case Results

Sign Up For ENLV Email News Alerts

Disclosure

RedChip Companies, Inc. research reports, company profiles, and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that RedChip Companies Inc. is an investor relations firm hired by certain companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles, or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca.

Enlivex Therapeutics (ENLV) is a client of RedChip Companies, Inc. ENLV agreed to pay RedChip Companies, Inc. an $8,000 monthly cash fee, beginning in February 2024, plus 25,000 warrants with an exercise price of $3.25 and 25,000 warrants with an exercise price of $4.25, for six month of investor awareness services. All warrants have a term of three years from date of issuance. ENLV also agreed to pay RedChip a one-time $50,000 fee for a national TV ad campaign aired September 11 to September 25, 2024, a one-time $37,500 fee for a national TV ad campaign aired October 14 to October 25, 2024, and a one-time $37,500 fee for a national TV ad campaign aired December 4 to December 17, 2024.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.