GreenPower Motor Company

$0.81

+0.0150 (1.90%)

All Electric-Pourpose Built-Zero Emmission

Analyst Report

Scaling Innovation in Zero-Emission Vehicles with a Path to Profitability

Company Overview Listen to Overview

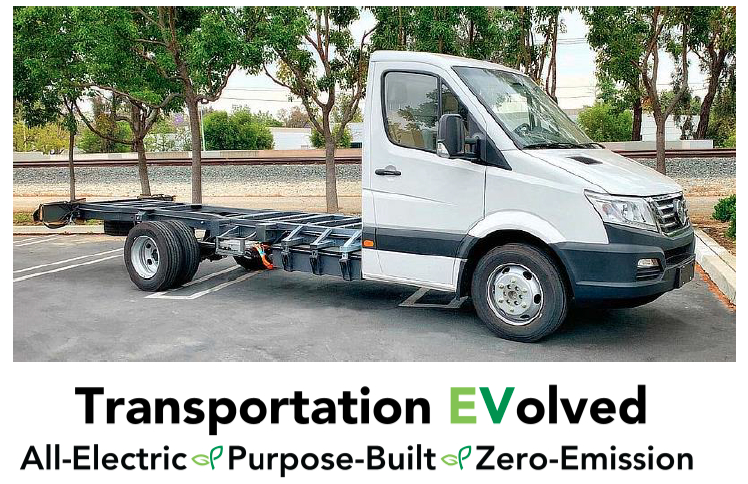

GreenPower Motor Company is advancing the adoption of electric vehicles (EVs) by making all-electric buses and trucks affordable, durable and easy to deploy. GreenPower offers commercial vehicles for the movement of goods and people that are built from the ground up to be all-electric and are never converted. This “clean sheet” design ensures a safe, sustainable and sensible form of transportation, allowing for optimal placement of the battery and propulsion systems, increasing the overall vehicle strength and significantly enhancing the battery weight distribution compared to other EVs. With more than 700 GreenPower all-electric, purpose-built, zero-emission EV Stars delivered, a substantial order pipeline and key partnerships across various sectors, GreenPower is poised for continued growth and market expansion.

GreenPower’s EV Star Cab & Chassis

Value Proposition Listen to Value Proposition

GreenPower Motor is a leading all-electric OEM specializing in zero-emission medium and heavy-duty vehicles for various markets, including cargo, transit and school buses. GreenPower has built approximately 900 vehicles to date, generating more than $90 million of revenue on 614 vehicles delivered in the past three fiscal years.

Led by a management team with extensive industry expertise and strategic vision, GreenPower benefits from financial incentives and regulatory mandates accelerating EV adoption. Programs like the California HVIP vouchers and other state initiatives, enhance the attractiveness of GreenPower’s products. Regulatory mandates in states like California and New York, alongside corporate fleet electrification commitments, drive demand for GreenPower’s vehicles. These factors reduce ownership costs for customers and create a strong growth framework for the company.

GreenPower trades at approximately 1x its trailing 12-month sales, compared to 2x-3x for competitors Workhorse and Nikola. It is the only company in its peer group with positive gross profit, while its competitors incur gross profit losses. GreenPower’s strong competitive position, sales growth, experienced leadership and favorable market conditions highlight its potential for sustained growth and value creation in the EV industry.

Targeting Attractive Markets Backed by Federal/State Incentives & Mandates

Investor Presentation

Investment Highlights Listen to Investment Highlights

Attractive market position with established track record of sales growth:

- Premier manufacturer and distributor of all-electric, purpose-built, zero-emission medium and heavy-duty vehicles serving the cargo and delivery market, shuttle and transit space and school bus sector.

- Strong sales track record, generating more than $90 million of revenue on 614 vehicles delivered in the past three fiscal years.

- Significant order book, fully serviceable with current production capacity at California and West Virginia facilities and contract manufacturing.

Favorable market dynamic:

- Attractive financial incentives and regulatory mandates accelerating EV adoption; financial and regulatory drivers lower total cost of ownership and establish a robust growth framework.

- Corporate commitments to fleet electrification bolster demand for zero-emission vehicles.

Strong financial performance and competitive positioning:

- Trades at ~1x trailing 12-month sales, offering a compelling valuation compared to peers; Workhorse and Nikola trade at 2x-3x sales.

- Unique within its peer group for reporting positive gross profit, contrasting with gross losses reported by competitors Workhorse, Nikola and Lion Electric.

Accomplished leadership team:

- Co-founder, CEO and Chairman Fraser Atkinson brings more than 14 years of experience at KPMG, LLP and significant public company leadership.

- President and Director Brendan Riley was among the first North America employees at BYD Motors, contributing to commercial EV product launches and manufacturing facility acquisitions.

Sign Up For GP Email News Alerts

Disclosure

RedChip Companies, Inc. research reports, company profiles, and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that RedChip Companies Inc. is an investor relations firm hired by certain companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles, or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca.

GreenPower Motor Company (GP) is a client of RedChip Companies, Inc. GP agreed to pay RedChip Companies, Inc. a $10,500 monthly cash fee, beginning in February 2024, for six month of investor awareness services. GP also agreed to pay RedChip a one-time $20,000 fee for a national TV ad campaign aired September 9 to September 20, 2024, a one-time $20,000 fee for a one-week national TV ad campaign beginning October 23, 2024, and a one-time $20,000 fee for a one-week national TV ad campaign aired November 26 to December 3, 2024.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.