LOBO EV

$1.56 -0.1210 -4.59% 6.7K

Driving the Future of Electric Mobility

Company Overview

LOBO EV is a leading innovator in electric mobility and green technology solutions. Headquartered in Wuxi, China, the Company designs and manufactures a diverse range of electric vehicles and smart equipment, including e-bicycles, e-mopeds, e-tricycles, electric four-wheeled shuttles, robotic lawn mowers, and solar-powered vehicles. By integrating advanced technologies like artificial intelligence, autonomous navigation, and connectivity, LOBO delivers innovative, reliable, and eco-friendly products tailored to diverse consumer and commercial needs. Recognized as an Alibaba.com “golden plus” supplier, LOBO has earned industry certifications for its commitment to quality and sustainability. With a growing global presence in North America, Europe, Latin America, and Asia-Pacific, LOBO is redefining modern mobility through accessible and energy-efficient transportation solutions that enhance lives and promote environmental responsibility.

Value Proposition

LOBO EV presents a compelling investment opportunity as a global leader in electric mobility and green technology solutions. The Company’s diverse product portfolio, which spans e-bicycles, e-mopeds, e- tricycles, four-wheeled shuttles, robotic lawn mowers, and solar-powered electric vehicles, positions LOBO at the forefront of sustainable transportation innovation.

Key differentiators include LOBO’s integration of advanced technologies like artificial intelligence, autonomous navigation, and solar energy systems, which align with the rising demand for energy-efficient, eco-friendly solutions. The Company’s focus on underserved markets, such as mobility solutions for the elderly and disabled, further highlights its commitment to inclusivity and innovation.

LOBO’s financial performance underscores its growth potential. The Company achieved a 49% year-over-year revenue increase in H1 2024, with units sold rising by 45% to 56,000 vehicles. Revenue for FY 2024 is projected to grow 80%, supported by the introduction of new products and entry into higher-margin international markets. LOBO also forecasts $5 million in additional sales from its U.S. subsidiary, LOBOAI, which focuses on distributing innovative products like robotic lawn mowers and AI-assisted mobility scooters. The Company’s expanding international footprint, including partnerships like Capital Fortress for U.S. and Australian distribution, positions it to capitalize on the $39 billion global e-bike and e-scooter market projected for 2028.

By prioritizing operational efficiency, quality, and sustainability, LOBO is well-positioned to capture market share in a rapidly evolving electric vehicle landscape. With an experienced management team driving innovation and execution, LOBO offers a unique value proposition for investors seeking to align with the future of mobility.

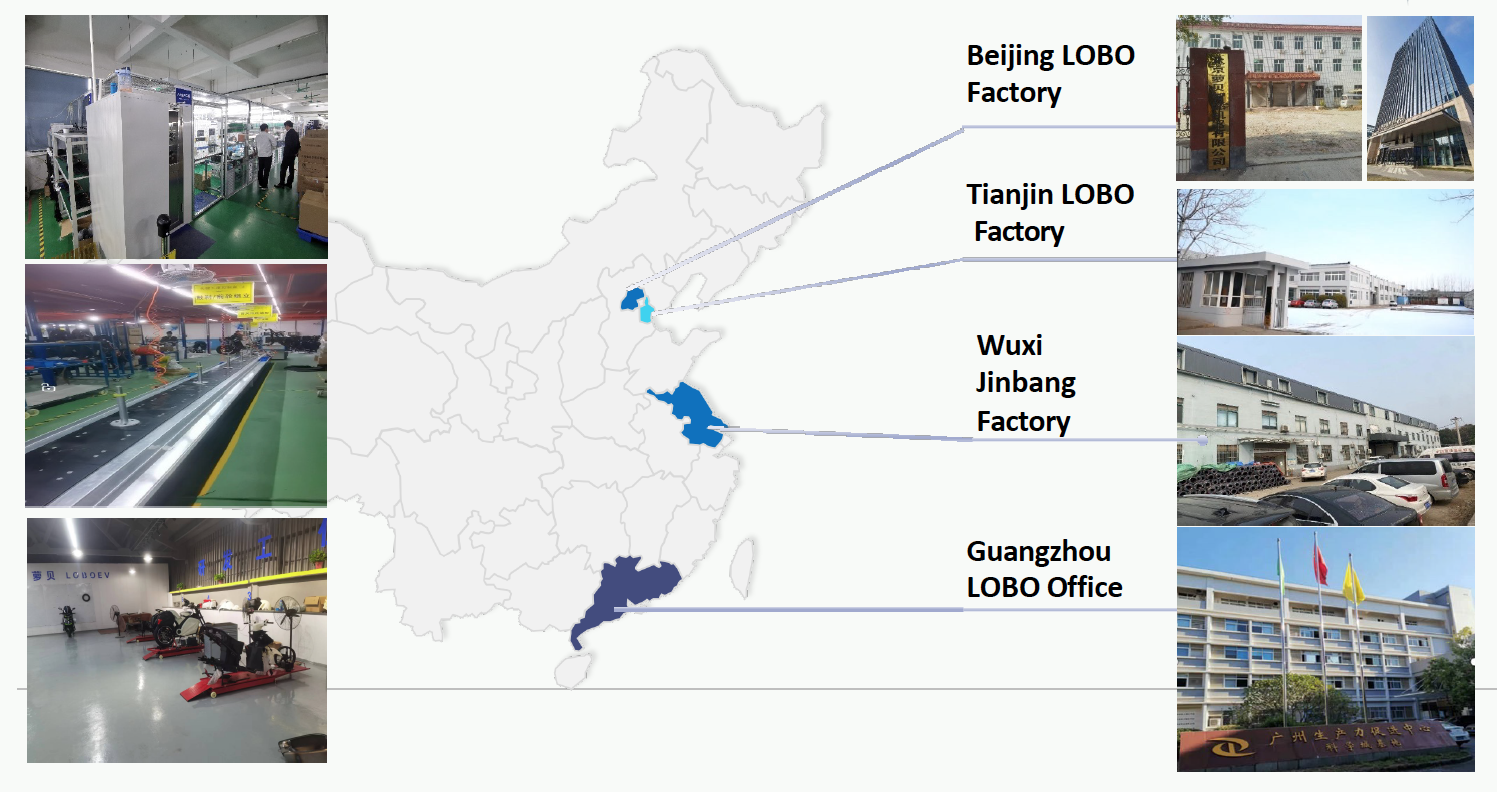

Established OEM & ODM Manufacturing Facilities

Investor Presentation

Investment Highlights

Diverse product portfolio

- Comprehensive offerings include e-bicycles, e-mopeds, e-tricycles, four-wheeled shuttles, robotic lawn mowers, and solar-powered vehicles

- Serves both consumer and commercial markets with innovative, eco-friendly solutions

Strong financial performance

- 49% YoY revenue growth in H1 2024, driven by a 45% rise in units sold

- FY 2024 revenue projected to grow 80%, supported by new product launches and global market entries

Rapid international expansion

- Active in North America, Europe, Latin America, and Asia-Pacific

- Recent partnerships, like Capital Fortress in the S. and Australia, and new initiatives, like the launch of new U.S. subsidiary, boost global footprint

- New manufacturing facilities enhance production capacity and efficiency while scaled operations support growing demand and higher-quality output

Innovation-driven growth

- Advanced technologies include AI, autonomous navigation, and solar-powered systems

- Product innovations meet market demands for energy-efficient and sustainable mobility

Expanding market opportunities

- Global e-bike, e-trike, and e-scooter market projected to grow from $28B (2023) to

- $39B by 2028 (6.6% CAGR)

- Robotic lawn mower market experiencing strong demand growth in North America and Australia

Visionary leadership

- Experienced management team focused on innovation and global market leadership

Sign Up For LOBO Email News Alerts

Disclosure

RedChip Companies, Inc. research reports, company profiles, and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that RedChip Companies Inc. is an investor relations firm hired by certain companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles, or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca.

LOBO EV (LOBO) is a client of RedChip Companies, Inc. LOBO agreed to pay RedChip Companies, Inc. a $12,500 monthly cash fee, beginning in February 2024, for six month of investor awareness services. LOBO also agreed to pay RedChip a one-time fifty-thousand dollar fee for a 10-day national TV ad campaign scheduled to air weekdays from March 27 through April 9, 2024.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.