Mobilicom Limited

$2.53

+0.0300 (-4.89%)

Cybersecure and robust end-to-end solutions for drones and robotics

Company Overview Listen to Overview

Mobilicom provides cybersecurity and robust solutions for drones and robotics. The Company is positioned to capture market leadership as the top end-to-end provider of hardware and software solutions in the rapidly growing defense and commercial drone and robotics market, a total addressable market expected to reach $8.5 billion by 2026. The conflict between Russia and Ukraine as well as wars in the Middle East are expected to further drive demand for Mobilicom’s drone cybertech solutions. The Company’s large portfolio of field-proven technologies includes cybersecurity, software, and hardware solutions that power, connect, guide, and secure drones and robotics. Through deployments across 18 countries with over 50 customers, Mobilicom generates revenues from hardware sales, cybersecurity and software licensing fees and professional support services. Its IP strategy includes patents and more often, trade secrets, in accordance with top-secret military applications. Mobilicom’s customers include the world’s leading defense and commercial drone manufacturers.

Value Proposition Listen to Value Proposition

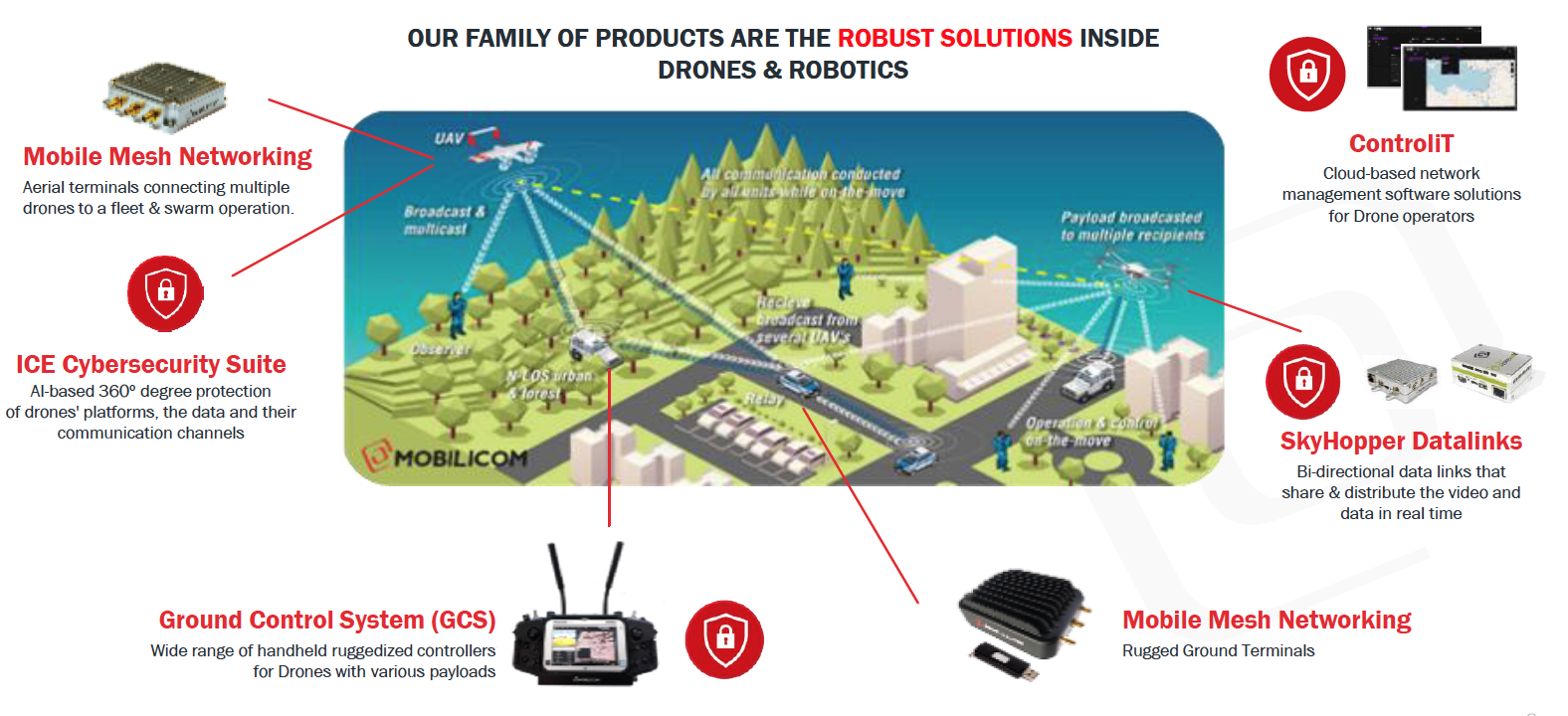

Mobilicom presents a compelling investment opportunity as a first mover in the $34 billion drone market, offering a unique end-to-end value proposition. It has established itself as a key player with proprietary solutions that enhance drone performance, offer comprehensive cybersecurity, and ensure faster time to market. The company's product suite, serving as the 'brain' inside drones, includes SkyHopper Datalinks, Ground Control Systems, Mobile Mesh Networking, the ICE Cybersecurity Suite, and CONTROLiT cloud management. These products work cohesively to control, guide, and protect drones from cyberattacks, offering significant competitive advantages in the rapidly growing small and mid-sized drone and robotics market.

Mobilicom’s intellectual property consists of trade secrets and 34 patent claims across two patent families issued in the U.S. and other countries, reinforcing its position as a leader in innovation. With over 50 customers across 18 countries, Mobilicom has achieved notable market penetration through "design wins". The company's 50 design wins to date provide a robust foundation for long-term revenue growth, with each win representing a large manufacturer that has integrated Mobilicom’s systems into their drone and robotic solutions.

Financially, Mobilicom is in a strong position. With a gross margin of 56% in the first half of 2024 primarily based on hardware sales, the company expects its revenues to be increasingly driven by Software-as-a-Service (SaaS) sales and recurring cybersecurity revenues from 2024 onwards. Revenues increased 232% year-over-year to $1.8 million in the first half of 2024, driven by initial production scale orders from U.S. and Israeli Tier-1 customers. As of June 30, 2024, Mobilicom had a cash balance of $9.7 million, a low burn rate, and no bank debt, indicating a solid financial footing for continued expansion. In summary, Mobilicom offers an attractive investment proposition given its first-mover advantage in the drone market, unique end-to-end offerings, expanding customer base, robust financial position, and significant potential for growth.

End-to-End Solutions

Investor Presentation

Investment Highlights Listen to Investment Highlights

Leadership in Drone Cybersecurity

- Developed ICE Cybersecurity Suite specifically for small-sized drones, validated and used by the Israeli Ministry of

- Recognized need for cybersecurity in drone market due to ongoing global conflicts and increasing corporate

Unique Market Positioning with Robust Business Model and Market Presence

- High-margin repeat hardware sales combined with software and cybersecurity recurring revenue model.

- Capitalizing on the rapidly growing small-size drone

- Solutions tailored to balance price, size, and performance ideal for commercial

- Only one-stop-shop provider of critical systems for commercial and defense drone

- Ability to penetrate markets with hardware offerings and expand by cross-selling software and cybersecurity

Impressive Clientele and Diversified Approach

- 50 design-win customers including 8 top-tier drone and robotics

- Blend of cybersecurity, software, and hardware solutions provides multiple avenues for

Significant Business Inflection Point

- Approaching a turning point with sticky design-win go-to-market

- Transition from design-win phase to initial production with deliveries to the Department of Defense.

- Significant penetration in Israel and the EU, expanding into the US

Influence on U.S. Cybersecurity Industry Standards

- Contributing to the U.S. Cybersecurity Industry Standard and actively engaging with U.S Congress to advocate for stronger drone

Strong Financial Position

- Secured $13 million USD in funding, maintains $10 million in available cash.

- Free of bank debts, loans, working capital debt, or

Intellectual Property and Proven Expertise

- Strong granted IP rights (34 patent claims across two patent families).

- Over 15 field-proven products used

Experienced Management Team

- Track record of successfully scaling companies from startup to growth phase and leading mergers with larger

Sign Up For MOB Email News Alerts

Disclosure

RedChip Companies, Inc. research reports, company profiles, and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that RedChip Companies Inc. is an investor relations firm hired by certain companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles, or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca.

Mobilicom (MOB) is a client of RedChip Companies, Inc. MOB agreed to pay RedChip Companies, Inc., a $6,500 monthly cash fee, beginning in November 2023, for 12 months of RedChip investor awareness services. MOB also agreed to pay RedChip a one-time twenty-five-thousand dollar fee for a five-day national TV ad campaign scheduled to air weekdays from April 15 through April 19, 2024.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.