Reviva Pharmaceuticals Holdings Inc.

$1.24 N/A -0.80% 469.4K

Addressing Significant Unmet Medical Needs

Company Overview

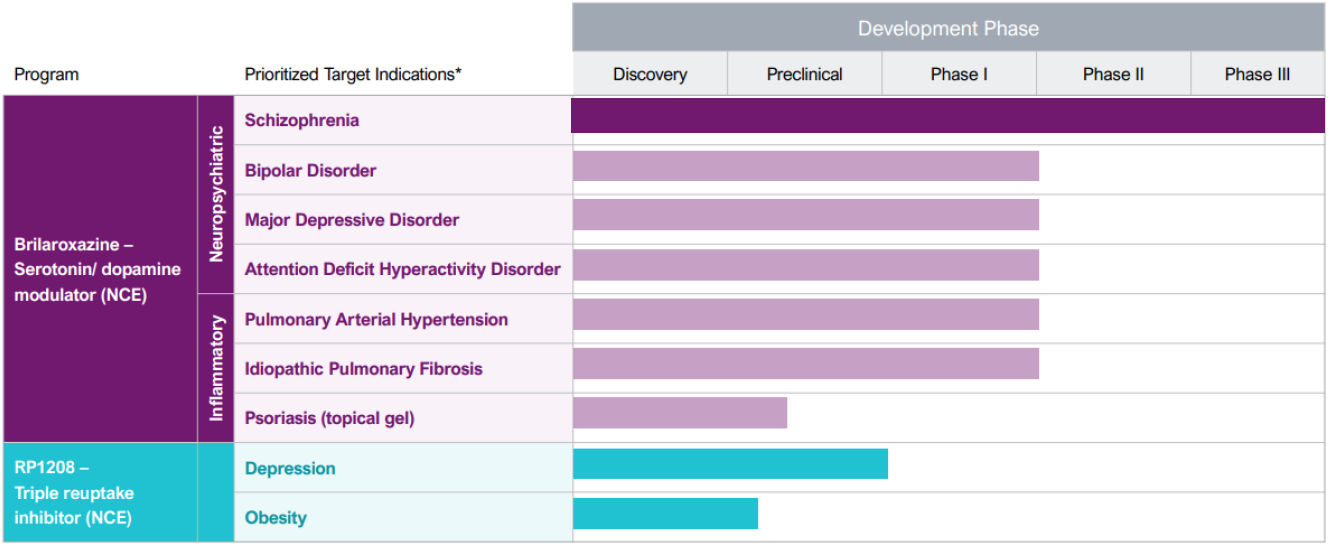

Reviva is a Phase 3 clinical-stage biopharmaceutical company that discovers, develops and seeks to commercialize next-generation therapeutics for diseases representing unmet medical needs and burdens to society, patients, and their families. Reviva's current pipeline focuses on the central nervous system, respiratory and metabolic diseases. Reviva's pipeline currently has two drug candidates, RP5063 (Brilaroxazine) and RP1208. Both are new chemical entities discovered in-house. Positive topline data for pivotal Phase 3 trial evaluating brilaroxazine for the treatment of schizophrenia was reported in Q3 2023. Reviva has been granted composition of matter patents for both RP5063 and R1208 in the US, Europe, and several other countries.

Value Proposition

Reviva is a well-funded Phase 3 biopharma with two in-house discovered platform drug candidates in its pipeline: RP5063, novel serotonin and dopamine receptor modulator, and RP1208, a novel triple reuptake inhibitor. Reviva recently completed its Phase 3 trial of brilaroxazine for the treatment of schizophrenia. The trial successfully met its primary endpoint, with brilaroxazine at the 50 mg dose achieving a statistically significant and clinically meaningful 10.1-point reduction in Positive and Negative Syndrome Scale (PANSS) total score compared to placebo (-23.9 brilaroxazine 50 mg vs. -13.8 placebo, p<0.001) at week 4. Brilaroxazine also achieved statistically significant and clinically meaningful reductions in all major symptom domains and secondary endpoints at week 4 with the 50 mg dose vs. placebo. Reviva plans to continue the clinical development of RP5063 for the treatment of other neuropsychiatric diseases including bipolar, major depressive disorder, ADHD, and psychosis in Alzheimer’s and Parkinson’s diseases. Reviva believes RP1208 is ready to begin IND enabling studies for depression and animal efficacy studies for obesity, following the receipt of adequate additional financing. Five analysts cover Reviva with buy ratings and a mean price target of $16.83 per share. Additionally, the US FDA has granted orphan designation to RP5063 for the treatment of PAH and IPF.

Addressing Significant Unmet Medical Needs

Investor Presentation

Investment Highlights

- Clinical-stage pharmaceutical company developing therapies for central nervous system, cardiovascular, metabolic, and inflammatory diseases

-

Extensive clinical pipeline with recently completed Phase 3 program in schizophrenia

- Phase 3 trial of brilaroxazine met primary and secondary endpoints

- Phase 3 data further confirmed the well-tolerated safety profile

- Brilaroxazine, a serotonin-dopamine signaling modulator, has potential to improve additional key disease drivers like neuroinflammation

- Orphan Drug Designation for the treatment of pulmonary arterial hypertension (PAH) & idiopathic pulmonary fibrosis (IPF)

-

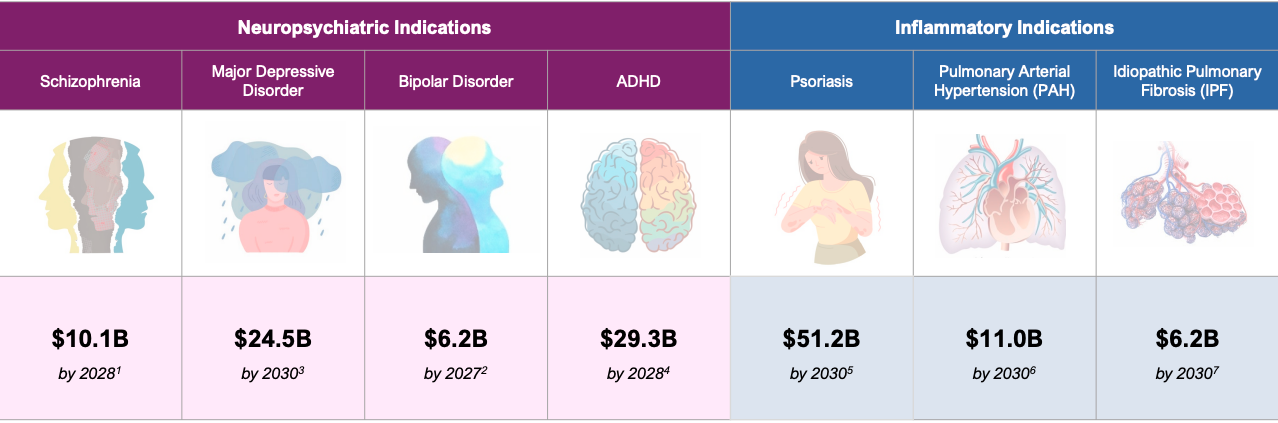

Addressable market opportunities:

- $10.1 billion for schizophrenia by 2028

- $24.5 billion for major depressive disorder by 2030

- $6.2 billion for bipolar disorder by 2028

- $29.3 billion for ADHD by 2025

- $51.2 billion for psoriasis by 2030

- $11.0 billion for PAH by 2030

- $6.2 billion for IPF by 2030

- Approx. $5 million cash on hand as of September 30, 2023; completed registered direct offering in November 2023 raising $30 million gross proceeds

- Strong management team with proven track record in biotech and pharma development

- Five analysts cover Reviva with an average price target of $16.83 per share

Sign Up For RVPH Email News Alerts

Disclosure

RedChip Companies, Inc. research reports, company profiles, and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that RedChip Companies Inc. is an investor relations firm hired by certain companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles, or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca.

Reviva Pharmaceuticals Holdings Inc. (RVPH) is a client of RedChip Companies, Inc. RVPH agreed to pay RedChip Companies, Inc. an $11,000 per month cash fee for 12 months of RedChip investor awareness services. The CEO of RedChip owns 8,553 shares of RVPH and may sell those shares at any time, including when you are buying. RVPH also agreed to pay RedChip an $80,000 fee for national TV ad campaigns aired December 13 to December 29, 2023, March 15 to March 22, 2024, and April 1 to April 3, 2024.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.