Splash Beverage Group Inc.

$0.21 +0.0281 +17.47% 3.2M

Company Overview

Splash Beverage Group, an innovator in the beverage industry, owns a growing portfolio of alcoholic and non-alcoholic beverage brands including Copa di Vino wines by the glass, SALT flavored tequilas, Pulpoloco sangrías, and TapouT performance hydration and recovery drinks. Splash’s strategy is to rapidly develop early-stage brands already in its portfolio as well as acquire and then accelerate brands that have high visibility or are innovators in their categories. Led by a management team that has built and managed some of the top brands in the beverage industry and led sales from product launch into the billions, Splash is rapidly expanding its brand portfolio and global distribution.

Value Proposition

Splash Beverage Group represents a unique and compelling opportunity through its powerful combination of experienced leadership, innovative product offerings, and expansive market penetration. The Company's revenues were up 22% in the nine months ended September 30, 2023 with year-to-date gross margin of 25%, demonstrating a proven ability to execute. With a seasoned management team boasting 140 years of collective experience in renowned brands (RedBull, Gallo, Diageo, Bacardi, Sparkling Ice, Muscle Milk, Jones Soda, SoBe, Fuze, Bob Marley Beverages), Splash Beverage is driving organic growth as it pursues a strategic acquisition model that seeks to leverage preexisting brand awareness and/or new innovations, positioning the Company at the vanguard of market trends. In September, the Company announced plans to acquire Western Son Vodka, which is expected to be Splash Beverage’s largest acquisition to date. Furthermore, products like SALT, the first 100% Agave flavored Tequila, and TapouT, with its 23 years of brand recognition, showcase the Company's commitment to ingenuity and customer appeal. Splash Beverage's growth is poised to accelerate as it strengthens its relationships with distributors and introduces its expanding portfolio of brands to new national, regional chains, and other sales channels. Three analysts currently cover the stock with buy ratings and price targets between $2.50 and $3.00 per share.

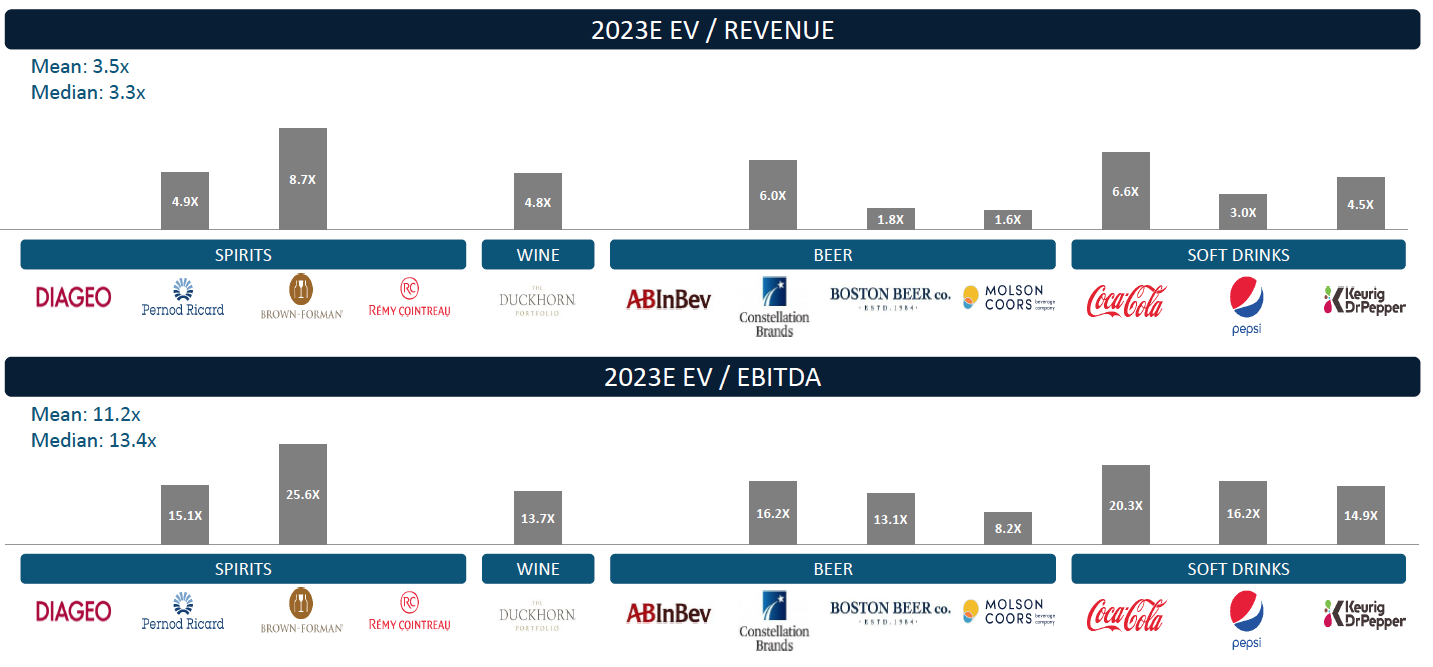

Publicly traded spirits companies command premium valuations relative to other beverage industries due to their superior margin profiles.

Investor Presentation

Investment Highlights

-

Established robust distribution network across multiple channels and growing

- Products are on retail shelves in multiple channels

- Chains are coming aboard quickly due to management’s past relationships and brands’ distribution network reach

- DSD distributors (Budweiser, etc.), Broad-liners (McLain, Cormark, KEHE, UNFI) all in place

- Geographic depth and breadth increasing in U.S. and internationally

-

Management team and board are proven leaders in the beverage industry

- Management team & Board has 140 years of combined experience in the beverage industry

- Brands managed by executives include: RedBull, Gallo, Diageo, Bacardi, Sparkling Ice, Muscle Milk, Jones Soda, SoBe, Fuze, Bob Marley Beverages

- Board hails from companies such as RedBull, Diageo, Bacardi, Nestlé, Coke, Miller Coors

-

Portfolio expansion focused on pre-existing brand awareness and/or new innovation

- Business model requires preexisting brand awareness and / or pure innovation when acquiring new brands

- Preexisting Awareness: TapouT has 23 years of brand awareness

- Innovation: SALT Naturally Flavored Tequila believed to be the 1st 100% Agave, 80 Proof line of flavored Tequilas, Copa di Vino & Pulpoloco highly innovative pack form innovation

- Impact of flavors on Rum, Vodka, even brown spirits have been significant... Tequila is next

-

Strong industry tailwinds

- Tequila volume has grown 72% over the last decade

- 10x growth of Flavored Spirits vs. Unflavored and 110% growth on “pure spirits” – single malt / barrel brown spirits and 100% agave tequilas

- Functional Beverages have grown 32% in the last five years

- Acquisition strategy underway; LOI to acquire Western Son Vodka announced in September 2023

Sign Up For SBEV Email News Alerts

Disclosure

RedChip Companies, Inc. research reports, company profiles, and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that RedChip Companies Inc. is an investor relations firm hired by certain companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles, or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca.

Splash Beverage Group (SBEV) is a client of RedChip Companies, Inc. SBEV agreed to pay RedChip Companies, Inc. seventy-five thousand shares of Rule 144 stock and a monthly cash fee of $7,500, beginning in August 2023, for 12 months of RedChip investor awareness services and consulting services. RedChip intends to and will, if possible, sell all of its shares immediately upon removal of the restriction, and you may be buying as RedChip is selling.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.