Soligenix Inc.

$2.36

+0.0790 (3.47%)

Rising to the challenges of rare disease treatment

Company Overview Listen to Overview

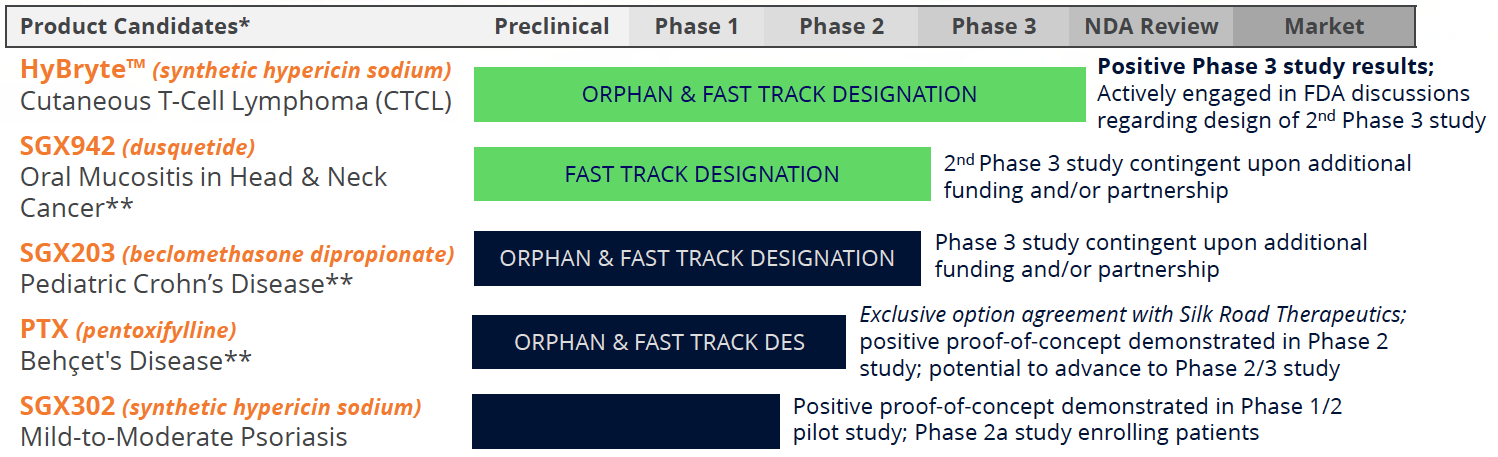

Soligenix is a late-stage biopharma company focused on developing and commercializing products to treat rare diseases where there is an unmet medical need. Its main business, Specialized BioTherapeutics, develops HyBryte™ (synthetic hypericin) for cutaneous T-cell lymphoma (CTCL). A Phase 3 study for HyBryte™ is complete and a confirmatory replication study is expected to begin by the end of 2024. HyBryte™ has received orphan drug and fast track designations from the FDA and orphan designation from the EMA. Soligenix is also evaluating synthetic hypericin (SGX302) for psoriasis with a Phase 2 study ongoing. Additionally, the company is advancing dusquetide (SGX942 and SGX945) for inflammatory diseases, including oral mucositis and Behçet's disease, with FDA "Fast Track" designation for the latter. A Phase 2 study with SGX945 in Behçet's disease is set to begin later this year.

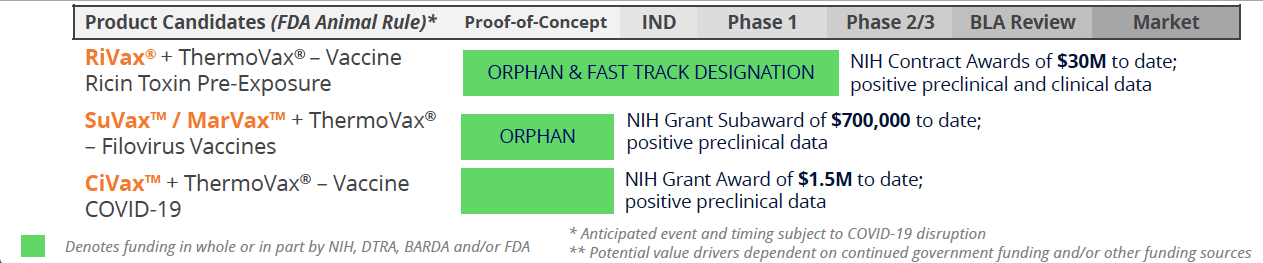

Soligenix’s Public Health Solutions segment develops products for severe medical conditions, such as the ricin toxin vaccine RiVax®, vaccines for Ebola (SuVax™) and Marburg (MarVax™), both granted orphan drug designation by the FDA. They are also developing a COVID-19 vaccine. All of these vaccines incorporate ThermoVax®, its heat stabilization platform. This segment is funded by agencies like NIAID, DTRA, and BARDA, with $60M+ in non-dilutive grant funding received to date.

Value Proposition Listen to Value Proposition

Soligenix, a late-stage biopharmaceutical company, showcases a strong portfolio with several products in advanced clinical stages, targeting a potential $2 billion in annual global sales. Notable among these is HyBryte™, a photodynamic therapy for cutaneous T-cell lymphoma (CTCL), a rare chronic cancer, which has demonstrated positive results in a Phase 3 study published in JAMA Dermatology. The company is gearing up for a follow-up confirmatory Phase 3 study, with HyBryte's™ market potential estimated at $250 million. Additional promising assets include SGX302, aimed at treating psoriasis, currently in a Phase 2a trial with a market potential exceeding $1 billion, and SGX945 for Behçet's Disease, with a Phase 2a set to begin later this year.

Moreover, Soligenix has secured collaborations across biotech, academia, and government to advance its public health pipeline, highlighted by non-dilutive funding and NIH grants supporting vaccine development. Recently, impressive data from its filovirus vaccine program has been published, showing complete protection in non-human primates against certain deadly viruses, with the FDA granting orphan drug designations. These developments position Soligenix as a compelling investment opportunity, with a strategic focus on unmet medical needs, robust partnership backing, and multiple potential upside catalysts expected in the next 6-12 months and beyond.

Specialized Biotherapeutics Pipeline

Commercial Targets: Unmet Medical Needs in Oncology and Inflammation

Investor Presentation

Investment Highlights Listen to Investment Highlights

- Robust pipeline with multiple fast track and/or orphan designated products, with potential for ~$2B in global annual sales

- Multiple upcoming milestones over the next 6-12 months

- Late-stage clinical assets, one with successful Phase 3 data readout

- Cutaneous T-cell lymphoma (HyBryte™ or SGX301)

- Positive statistically significant results achieved in first Phase 3 study; published JAMA Dermatology

- Second confirmatory Phase 3 study of similar design accepted by EMA; FDA discussions remain ongoing

- Significant commercial opportunity in area of unmet medical need; estimated global market potential >$250M

- Psoriasis (SGX302)

- Positive and statistically significant results achieved in Phase 1/2 study

- Expanded Phase 2a study in mild-to-moderate psoriasis ongoing after demonstration of biological effect in all nine of the initial subjects

- Significant commercial opportunity in area of unmet medical need; estimated global market potential >$1B

- Aphthous Ulcers in Behçet's Disease (SGX945)

- FDA IND and Phase 2a protocol clearance

- Fast-Track designation received

- Significant commercial opportunity in area of unmet medical need; estimated global market potential >$200M

- Collaborations with biotech, academia and government agencies

- FDA orphan drug designations recently granted to the active ingredients in the Company’s MarVax™ and SuVax™ vaccine programs

- Non-dilutive government funding helps cover operating expenses

- $60M+ received to date; NIH grant awards supporting vaccine development; potential for up to 3 Priority Review Vouchers (PRVs)

- Experienced management team/renowned advisors with record of success

- $48 price target from Alliance Global Partners

Public Health Solutions Pipeline

Funded by Government: Medical Countermeasures for Civilian & Military Use

Sign Up For SNGX Email News Alerts

Disclosure

RedChip Companies, Inc. research reports, company profiles, and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that RedChip Companies Inc. is an investor relations firm hired by certain companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles, or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca.

Soligenix (SNGX) is a client of RedChip Companies, Inc. SNGX agreed to pay RedChip Companies, Inc. 50,000 shares of Rule 144 stock and a monthly cash fee of $10,000, beginning in April 2023, for 12 months of RedChip investor awareness services. RedChip intends to and will, if possible, sell all of its shares immediately upon removal of the restriction, and you may be buying as RedChip is selling. SNGX also agreed to pay RedChip a one-time $50,000 fee for a national TV ad campaign aired June 11 through June 25, 2024, and a one-time $37,500 fee for a national TV ad campaign aired September 16 through October 4, 2024.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.