Spectaire Holdings Inc.

$0.17 +0.1110 -21.19% 1.7M

Transform your perspective with real-time emission data

Company Overview

Spectaire Holdings represents a pioneering leap in environmental technology with its flagship AireCore system, a game-changer in emissions measurement and management. This innovative system, which includes a cutting-edge emissions measurement device, encrypted cloud storage, and intuitive desktop/mobile applications, offers a comprehensive solution for tracking and reducing carbon footprints at a fraction of the cost of traditional methods.

With a business model combining upfront low-cost hardware sales with recurring service revenues, Spectaire is set to democratize access to mass spectrometry, mirroring the transformative shifts seen from mainframes to laptops and landlines to cellular phones.

The Company's technology has garnered significant interest, evidenced by substantial orders and pilots from major industry players like Nabors (NYSE: NBR), highlighting Spectaire's potential to revolutionize emissions management across sectors. Backed by a seasoned management team with a track record of technological innovation and commercial success, Spectaire is well-positioned to lead the market in emissions mitigation strategies, offering a lucrative opportunity for investors looking to contribute to a sustainable future while achieving substantial returns.

Value Proposition

In the rapidly evolving environmental technology sector, Spectaire is positioned as a compelling opportunity with its disruptive AireCore system—a cutting-edge innovation in emissions measurement and management. Spectaire’s pioneering approach aims to solve a critical global challenge: the efficient and accurate tracking of emissions. At a time when environmental concerns are at the forefront of global policy and corporate responsibility, Spectaire's technology offers a much-needed solution that is both cost-effective and scalable, contrasting sharply with the prohibitively expensive and cumbersome options currently dominating the market.

Spectaire has captured interest from key industry players, including Nabors (NYSE: NBR), an oil and gas drilling contractor with the largest land drilling fleet in the world. Spectaire has signed a purchase order for 500 units (at $2,000/unit) and has the potential to order an additional 1,500 units. The annual recurring services revenue potential from the current 500-unit PO with NBR is estimated at $5 million ($10,000/unit per year). Spectaire’s sales pipeline includes pilots and prospective pilots with UPS, Bison Trucking, and Pacific Northwest National Labs (PNNL).

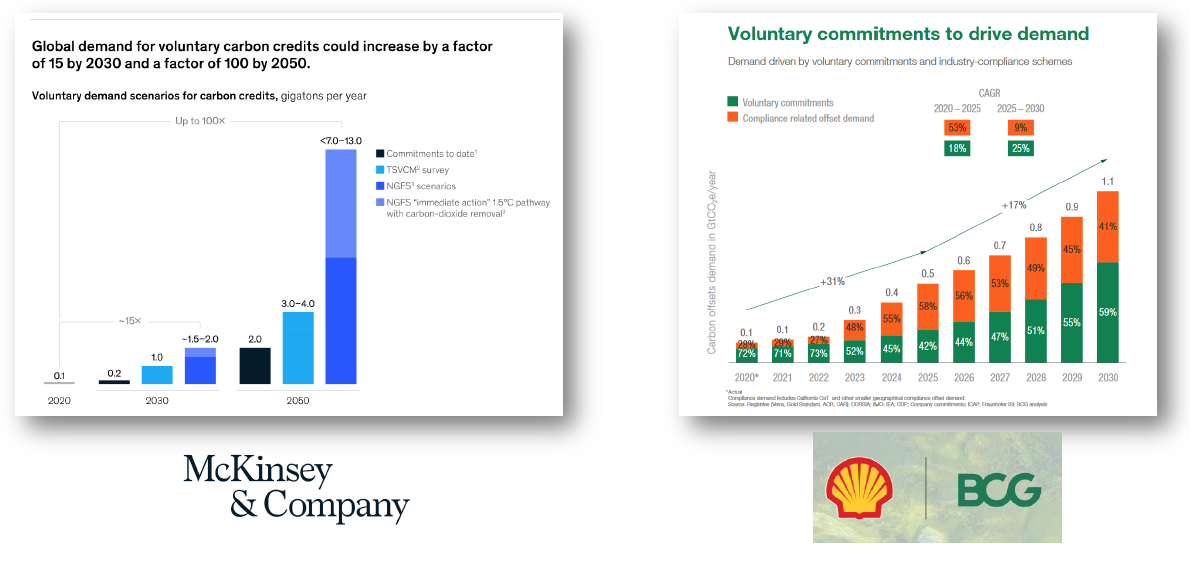

Spectaire's strategic position in the burgeoning carbon credits market enhances its investment thesis. As the world gravitates towards net-zero targets, the demand for verifiable, permanent carbon credits is surging—an arena where Spectaire's technology can play a pivotal role. By enabling precise emissions tracking and the generation of technology-based carbon credits, Spectaire addresses a critical need, opening additional revenue streams and further solidifying its market position. Carbon credits could ultimately generate billions of dollars in annual sales for Spectaire.

Backed by an experienced management team with a proven track record in technology innovation and market scaling, Spectaire is well-equipped to navigate the complexities of growth and competition. In a world increasingly driven by both technological advancement and environmental consciousness, Spectaire represents a unique blend of growth potential, market relevance, and societal impact, making it a compelling choice for the savvy investor.

Exponential Growth Projected for Verified Carbon Standard (VCS) Market

Investor Presentation

Investment Highlights

-

Innovative emissions measurement technology

- Proprietary AireCore system revolutionizes emissions tracking through miniaturized system with high accuracy and lower costs

- Comprehensive solution with device, encrypted cloud storage, and desktop/mobile applications

- Significant cost and size advantage over traditional methods (AireCore system at $3,000 vs. competitors at $100,000+)

-

Significant market potential and expanding sales pipeline

- Positioned in a rapidly growing Air Quality Monitoring Systems (AQMS) market valued at $5 billion in 2021

- Anchor customers include: Nabors (NYSE: NBR) - signed purchase order (500 units at $2,000/unit with $10,000 annual recurring revenue per unit); and Mosolf – signed purchase order (300 units)

- Diverse customer pipeline across sectors with verbal commitments and ongoing pilots (including prospective pilot with UPS: 10 units with 126,000 unit potential)

-

Technology supports the generation of verifiable carbon credits

- AireCore enables daily savings vs. baseline tracking, vital for accurate carbon credit calculation

- Meets growing demand for carbon credits with public net-zero targets

-

Robust financial model and growth trajectory

- Manufacturing capacity set for significant scaling (10,000 units annually would generate $50 million in annual hardware and services revenue with an estimated $19 million EBITDA)

-

Highly experienced management team

- Leadership team with proven expertise in technology development, scaling, and market penetration

Sign Up For SPEC Email News Alerts

Disclosure

RedChip Companies, Inc. research reports, company profiles, and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that RedChip Companies Inc. is an investor relations firm hired by certain companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles, or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca.

Spectaire Holdings (SPEC) is a client of RedChip Companies. SPEC agreed to pay RedChip Companies, Inc. a $4,000 monthly cash fee, beginning in March 2024, and 80,000 shares of SPEC Rule 144 stock for 12 months of RedChip investor awareness services. RedChip intends to and will, if possible, sell all of its shares immediately upon removal of the restriction, and you may be buying as RedChip is selling. SPEC also agreed to pay RedChip a one-time fifty-thousand dollar fee for a 10-day national TV ad campaign scheduled to air weekdays from April 8 through April 19, 2024, and a one-time $10,000 fee for a five-day national TV ad campaign aired in August 2024.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.