SPI Energy Co. Ltd. (NASDAQ: SPI)

$0.3159

-0.0013 ( +3.57% ) 28.5K

SPI Energy Co Ltd offers photovoltaic solutions for business, residential, government, and utility customers and investors. The company provides a range of engineering, procurement, and construction services to third-party project developers. It is also engaged in the development, manufacture, and marketing of various PV modules. It procures PV modules and other equipment for project construction from independent suppliers and contract work to third-party EPC contractors in areas such as logistics, installation, construction, and supervision. The company's geographical segments are the United Kingdom, Australia, United States, Greece, Japan, and Italy, of which the majority of its revenue comes from Australia.

Market Data

Open

$0.3159

Previous close

$0.3172

Volume

28.5K

Market cap

$10.02M

Day range

$0.3060 - $0.3170

52 week range

$0.2700 - $1.2600

SEC Filings

| Form Type | Description | Pages | Date |

|---|---|---|---|

| 8-k/a | 8K-related | 14 | Dec 18, 2023 |

| 8-k | 8K-related | 13 | Dec 12, 2023 |

| 8-k | 8K-related | 15 | Nov 29, 2023 |

| 10-q | Quarterly Reports | 71 | Nov 20, 2023 |

| nt | Quarterly Reports | 1 | Nov 09, 2023 |

| 8-k | 8K-related | 12 | Nov 08, 2023 |

Latest News

SPI Energy

$0.32 -0.0013 +3.57% 28.5K

(NASDAQ: SPI)

Company Overview

SPI Energy is a global renewable energy company and provider of solar storage and electric vehicle (EV) solutions that was founded in 2006 in Roseville, California and is headquartered in McClellan Park, California. The Company has three core divisions: SolarJuice, offering solar wholesale distribution as well as residential solar and roofing installation and solar module manufacturing (Solar4America & SEM Wafertech); SPI Solar and Orange Power, a commercial and utility-scale solar division; and EdisonFuture, an EV and green hydrogen technology division. SolarJuice is the leader in renewable energy system solutions for residential and small commercial markets and has extensive operations in the Asia Pacific and North America markets. The SPI Solar commercial and utility solar division provides a full spectrum of EPC services to third party project developers, and develops, owns and operates solar projects that sell electricity to the grid in multiple regions, including the U.S., U.K., and Europe. SPI maintains global operations in North America, Australia, Asia and Europe and is also targeting strategic investment opportunities in fast growing green energy industries such as battery storage, charging stations, and other EVs which leverage the Company's expertise and substantial solar cash flow.

Innovating a Renewable Greener World

Value Proposition

Delivering competitive, clean energy solutions to customers for more than 15 years, SPI is an established renewable energy player with global operations in key markets in Asia, Australia, North America, and Europe. SPI has assets of $230 million and currently trades for a fraction of its trailing 12-month revenue of $206 million, a significant discount to peer group multiples. SPI reported positive net income from continuing operations in Q3 2023 and has provided full year net income guidance of $29 million to $36 million on revenues of $250 million to $300 million. To unlock additional shareholder value, SPI completed an IPO spinoff of Phoenix Motor (Nasdaq: PEV) in 2022 (currently owns 25%) and expects to complete IPOs of Solarjuice (Nasdaq: SJA – tentative) and Orange Power in 2024. SPI is currently covered by Maxim Group with a buy rating and $6 per share price target.

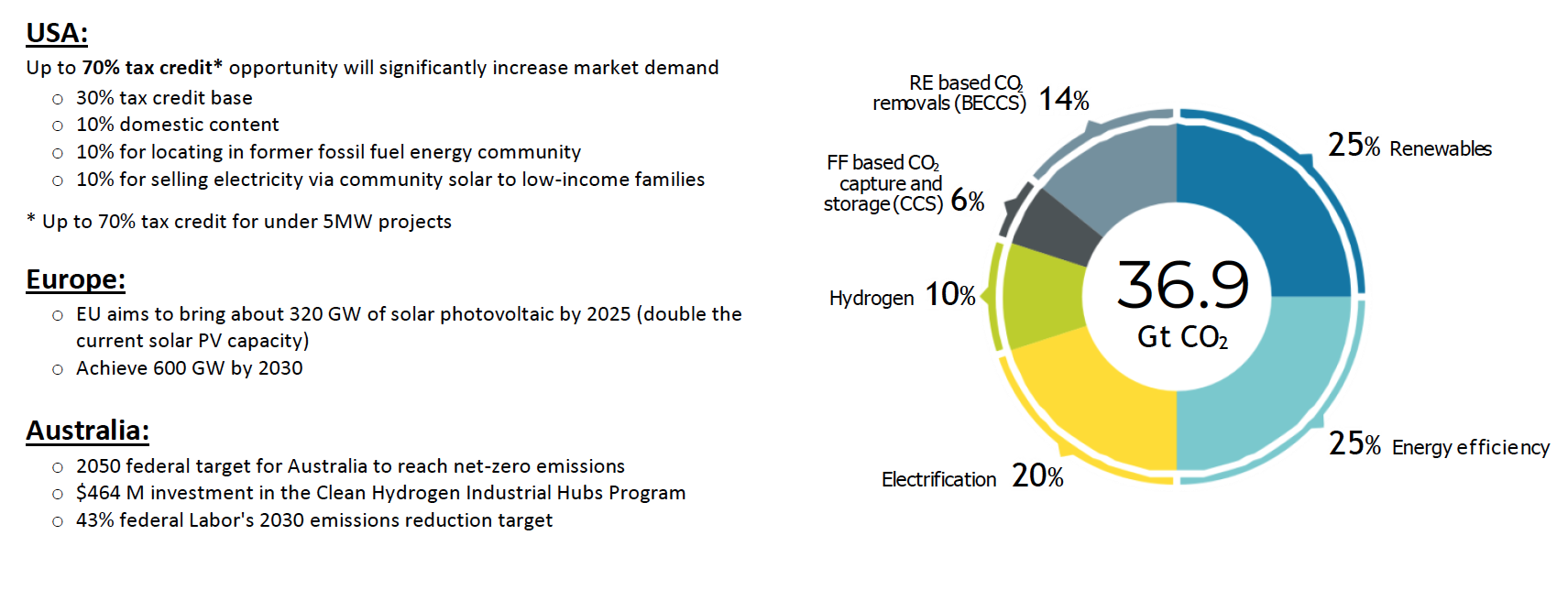

Attractive Regulatory Tailwinds Driving Accelerated Demand Growth

Investor Presentation

Investment Highlights

-

Strong revenue growth with clear path to profitability in 2023

- Generated $177.5 million revenue for 2022, exceeding guidance and up 9.6% year-over-year; trailing 12-month revenue of $206.9 million as of September 30, 2023

- Reported positive net income from continuing operations in Q3 2023

- Projecting $250-$300 million revenue with expectations of $29 million to $36 million net income for 2023

-

Favorable regulatory environment boosting demand globally

- Provisions in U.S. Inflation Reduction Act create attractive incentives for producing solar wafers and solar modules in the US ($12 per square meter of wafers produced)

-

Diversified renewable energy portfolio targeting key verticals

- Foundation for rapid growth in solar, battery storage, electric vehicle, and hydrogen sectors

- Generating consistent cashflows from strong & growing pipeline of solar projects in US

- Launched first large-scale solar wafer manufacturing facility in US; opening second facility in SC in 2023

-

Unlocking value through pure-play spin-offs

- Phoenix Motor (Nasdaq: PEV); SPI owns 25% of PEV after divesting majority stake in September 2023

- Solarjuice (Nasdaq: SJA – tentative); SPI expects to own 90% of SJA post-spin off

- Orange Power (spin-off process underway)

-

Diversified international management team with deep industry experience

- Chairman & CEO has led several NYSE and Nasdaq companies and is a pioneer in the renewable energy sectorwith more than two decades experience in solar, battery storage, and EVs

- COO has more than 30 years of experience in solar and electronics industries

- VP of Solar Development has led $900M+ of renewable energy projects across US since 2010

Archived Webinar

RedChip Investor Group Call with SPI Energy (NASDAQ: SPI)

Thursday, January 25, 2024

Disclosure

RedChip Companies, Inc. research reports, company profiles, and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that RedChip Companies Inc. is an investor relations firm hired by certain companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles, or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca.

SPI Energy (SPI) was a client of RedChip Companies, Inc. SPI agreed to pay RedChip Companies, Inc. 25,000 shares of Rule 144 stock and a monthly cash fee of $6,500, beginning in August 2019, for 12 months of RedChip investor awareness services and consulting services. RedChip intends to and will, if possible, sell all of its shares immediately upon removal of the restriction, and you may be buying as RedChip is selling.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.