Sharps Technology

$0.34

+0.0228 (6.88%)

Collaboration. Innovation. Novel Technology. Making the World a Healthier Place.

Company Overview Listen to Overview

Sharps Technology is an innovative medical device and pharmaceutical packaging company offering patented, best-in-class smart-safety syringe products to the healthcare industry. The Company’s product lines focus on providing ultra-low waste capabilities, that incorporate syringe technologies that use both passive and active safety features. Sharps also offers products that are designed with specialized copolymer technology to support the prefillable syringe market segment. The Company has a manufacturing facility in Hungary and has partnered with Nephron Pharmaceuticals to expand its manufacturing capacity in the U.S. A transformative asset acquisition of Nephron’s InjectEZ facility in South Carolina, once completed, places Sharps on a clear path for rapid growth.

Value Proposition Listen to Value Proposition

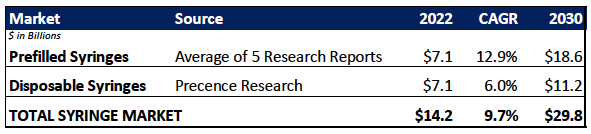

Sharps Technology signed a $200 million five-year Sales Agreement and enhanced its Asset Purchase Agreement to acquire Nephron Pharmaceuticals' InjectEZ facility. This acquisition, announced in May 2024 and expected to close in 2024, will position Sharps as North America's first fully dedicated specialized polymer prefillable syringe manufacturer. The facility, set to begin product deliveries in 2025, is expected to generate over $35 million in revenue in the first 12 months, with potential to exceed $50 million by 2026 and $100 million by 2028. Recent FDA recalls and tariffs on Chinese syringes have boosted demand for Sharps' products, which are increasingly preferred over glass syringes. Sharps is engaging with major pharmaceutical companies, retail chains, and healthcare distributors to expand its market presence. With a clear path to substantial revenue growth and profitability, Sharps represents a compelling opportunity in a market forecasted to reach $29.8 billion by 2030.

Multi-Billion-Dollar Market Opportunity

Investor Presentation

Investment Highlights Listen to Investment Highlights

$200 million, five-year sales agreement with Nephron

- $35 million expected during the first 12 months of sales

Strong product line of patented smart safety syringe systems

- Products are FDA, WHO, and CE Mark approved

- Launching new prefilled syringe systems with acquisition of InjectEZ facility

Asset purchase agreement to acquire InjectEZ manufacturing facility

- State-of-the-art facility with fully automated syringe system manufacturing, packaging, and distribution in West Columbia, SC

- Strengthens manufacturing capacity and allows Sharps to serve the broader healthcare market

- Facility has capacity to generate $50+ million revenue in 2026 and potentially $100+ million in revenue by 2028

Poised for rapid growth and superior financial performance

- Signed global sales and distribution agreement with Roncadelle, a leader in novel medical drug delivery devices

- Developing additional copolymer prefillable syringe sales opportunities by collaborating with Fortune 500 medical product distributors, branded/generic pharma leaders, and companies in the rapidly expanding GLP-1 market

- Low corporate overhead structure

Large and growing markets with unmet need

- Total syringe market growing faster than GDP; disposables growing at 2x GDP and prefillable growing at 4x GDP

- Prefillable cyclic olefin copolymer (COC) demand growth outstripping industry capacity; new InjectEZ facility is the only dedicated prefillable COC syringe manufacturing facility in North America

Strong management team with extensive experience in drug delivery manufacturing and product development

- Long-standing relationships with pharma companies and 503B organizations that comprise company’s target customer base

Sign Up For STSS Email News Alerts

Disclosure

RedChip Companies, Inc. research reports, company profiles, and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that RedChip Companies Inc. is an investor relations firm hired by certain companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles, or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca.

Sharps Technology, Inc (STSS) is a client of RedChip Companies Inc. STSS, agree to pay RedChip Companies, Inc. a $10,500 monthly cash fee, beginning in March 2022, and 35,000 of STSS Rule 144 stock for 12 months of RedChip investor awareness services. RedChip intends to and will, if possible, sell all of its shares immediately upon removal of the restriction, and you may be buying as RedChip is selling. STSS also agreed to pay RedChip a one-time cash fee of fifty-thousand dollars for a 10-day national TV ad campaign aired August 2024. The CEO of RedChip owns 9,500 shares of STSS common stock and may sell those shares at any time, including when you are buying.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.