bioAffinity Technologies

$0.77

+0.0285 (3.84%)

Detecting lung cancer early with advanced flow cytometry

Company Overview Listen to Overview

bioAffinity Technologies addresses the urgent need for noninvasive, accurate early-stage cancer diagnosis and broad-spectrum cancer treatments. Lung cancer is the leading cause of cancer-related deaths. The Company’s first product, CyPath® Lung, improves early-stage detection of lung cancer, leading to increased survival, fewer unnecessary invasive procedures, reduced patient anxiety, and lower medical costs. CyPath® Lung, a laboratory developed test (LTD), is patient-friendly and physician focused. Physicians order CyPath® Lung for their patients after lung cancer screening or other imaging reveals a suspicious finding.

Patients collect their sample at home and ship overnight in a pre-paid envelope to the Company’s commercial laboratory, Precision Pathology Laboratory Services, where data is collected using flow cytometry. Proprietary automated data analysis, developed using artificial intelligence (AI), detects lung cancer by analyzing the lung microenvironment to identify cell populations that indicate malignancy. CyPath® Lung has shown high sensitivity (92%), high specificity (87%) and high accuracy (88%) in detecting early-stage lung cancer in patients with small pulmonary nodules less than 20 millimeters. Research and optimization of the Company’s platform technologies are conducted in its laboratories at Precision Pathology.

Value Proposition Listen to Value Proposition

bioAffinity Technologies is an emerging leader in early-stage cancer diagnostics. Its flagship product, CyPath® Lung, a noninvasive test for early detection of lung cancer, has demonstrated high sensitivity, specificity, and accuracy. Early detection of lung cancer significantly increases survival rates and reduces healthcare costs. bioAffinity grew Q2 2024 orders for CyPath® Lung by 217% over Q1, reflecting the company’s effective sales strategy and increasing market demand. In October 2024, bioAffinity secured a U.S. Federal Supply Schedule contract for CyPath® Lung, making the test available to U.S. veterans and federal health service patients, which could further accelerate sales growth in the quarters ahead. Approximately 8,000 veterans are diagnosed and treated for lung cancer annually, according to the U.S. Department of Veterans Affairs. The lung cancer worldwide diagnostics market was valued at $4.7 billion in 2023 and is projected to grow at a 6.5% CAGR through 2030. The Company’s innovative flow cytometry platform, supported by AI-driven data analysis, is also being developed for noninvasive diagnosis of COPD and asthma—two markets expected to reach $8.2 billion by 2027. With growing sales, a highly experienced leadership team, robust patent portfolio, and 35% insider ownership, bioAffinity Technologies presents a compelling opportunity as it capitalizes on multi-billion-dollar opportunities.

Hear How Physicians Are Using CyPath® Lung

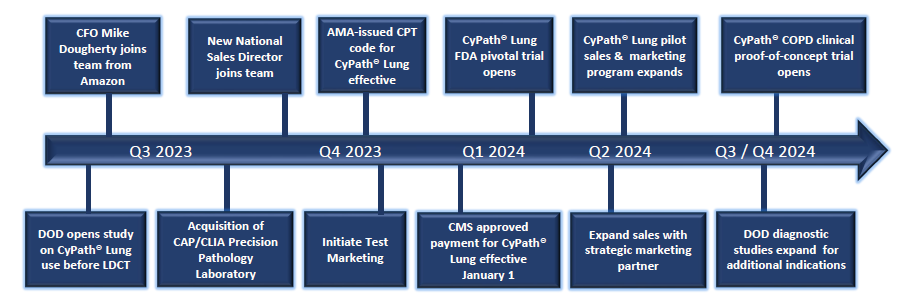

Recent & Anticipated Milestones

Investor Presentation

Investment Highlights Listen to Investment Highlights

Commercialization of CyPath® Lung test underway

- Q2 2024 CyPath® Lung orders up 217% over Q1 2024

- Expanding sales of CyPath® Lung beyond initial pilot market in Texas

- Awarded US Federal Supply Schedule contract, making CyPath® Lung available to US veterans and other federal health services patients

- US Department of Defense purchased CyPath® Lung for an observational study and research into the test’s use for screening

- AMA issued a CPT code for CyPath® Lung; CMS payment became effective January 1, 2024 for Medicare and private payor reimbursement.

Lung cancer is the leading cause of cancer-related deaths worldwide

- Lung cancer is frequently detected in advanced stages, resulting in limited treatment options

- Global lung cancer diagnostics market was valued at $4.7B in 2023

- Company holds strong international patent portfolio supporting worldwide commercialization

Company’s CAP/CLIA laboratory forecasting between $9.2 million and $9.6 million revenue for 2024, up 23% over 2023

- Company captures 100% of CyPath® Lung revenues

- Precision Pathology Laboratory Services provides capacity for nationwide expansion under one structure

- Accretive acquisition completed in 2023Experienced leadership team

- CEO Maria Zannes (30+ years executive-level experience)

- Chief Science Officer Dr. Willam Bauta (20+ years of scientific research and commercial product development experience)

- CFO J. Michael Edwards (30+ years financial management and business strategy experience); served as bioAffinity’s consulting CFO from 2014-2023

Physician-Focused, Patient-Friendly Market Opportunity

Sign Up For BIAF Email News Alerts

Disclosure

RedChip Companies, Inc. research reports, company profiles, and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that RedChip Companies Inc. is an investor relations firm hired by certain companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles, or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca.

bioAffinity (BIAF) is a client of RedChip Companies, Inc. BIAF agreed to pay RedChip Companies, Inc. an $8,500 monthly cash fee, beginning in October 2023 , and 50,000 shares of Rule 144 stock (subject to board approval) for 12 months of investor awareness services. RedChip intends to and will, if possible, sell all of its shares immediately upon removal of the restriction, and you may be buying as RedChip is selling. BIAF also agreed to pay RedChip a $100,000 fee for national TV ad campaigns aired February 21 to March 5, 2024, April 1 to April 12, 2024, May 16 to June 7, 2024, June 27 to July 12, 2024, and July 22 to July 26, 2024, a $30,000 fee for a national TV ad campaign aired September 12 to October 8, 2024, and a $20,000 fee for a national TV ad campaign aired December 11 to December 17, 2024.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.