BioVie

$2.17 -0.0100 -0.46% 200.9K

Developing Care for Unmet Medical Challenges

Company Overview

BioVie is a clinical-stage company developing innovative drug therapies for the treatment of neurological and neurodegenerative disorders and advanced liver disease. In neurodegenerative disease, the Company’s drug candidate bezisterim inhibits inflammatory activation that leads to neuroinflammation, and insulin resistance believed to be drivers of Alzheimer’s Disease (AD) and Parkinson’s Disease (PD). Bezisterim is also being developed to address Long COVID, with a Phase 2 trial expected to commence in early 2025. In liver disease, the Company’s Orphan drug candidate BIV201 (continuous infusion terlipressin), with U.S. FDA Fast Track status, is being evaluated and discussed with guidance received from the FDA regarding the design of Phase 3 clinical testing of BIV201 for the treatment of ascites due to chronic liver cirrhosis. The active agent is approved in the U.S. and in about 40 countries for related complications of advanced liver cirrhosis.

Value Proposition

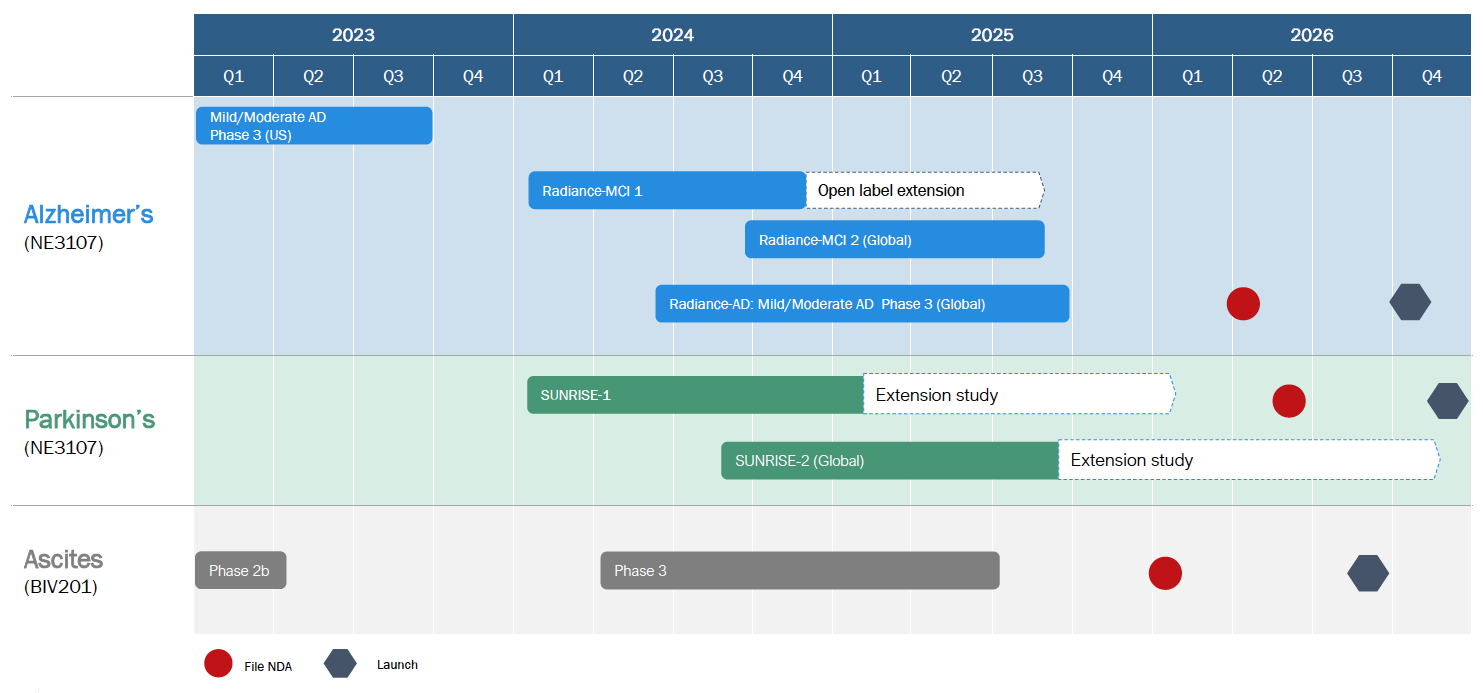

BioVie is strategically positioned for significant value creation, supported by a robust cash position and a series of anticipated catalysts over the next 12 months and beyond. Key upcoming catalysts include the launch of the Parkinson’s Phase 2b trial in late 2024 or early 2025, the launch of an exploratory Phase 2 trial in Long COVID in early 2025, and the next Alzheimer’s Phase 3 trial using a new once-daily formulation of bezisterim in mid-2025. Additionally, ongoing partnership discussions for bezisterim's geographic rights and the planned launch of an ascites Phase 3 trial upon securing a partner further support the investment case for BioVie.

Far-reaching impact of TNFα-mediated chronic low-grade inflammation

Investor Presentation

Investment Highlights

Lead asset bezisterim (formerly NE3107) modulates the production of TNFα. In clinical trials, many patients treated with bezisterim experienced:

- Reduced inflammation and the associated insulin resistance

- Improved motor control and “morning on” symptoms in PD

- Improved cognition and function, lowered amyloid β and p-tau levels, and improved brain imaging scans in AD

- Lowered DNA methylation levels

Significant unmet medical needs in PD, AD, and Long COVID

- $30+ billion annual peak sales potential in PD for bezisterim

- $3+ billion annual peak sales potential in AD for bezisterim

- 17M adults in US suffer from Long COVID; est. 30K new patients daily

Among competitive molecules exploring neuroinflammation and AD, bezisterim is the only one that:

- Has published randomized, double-blinded, placebo Phase 2 results potentially suggesting reduction in inflammation and insulin resistance in a major population and warranting further review in Phase 3.

- Potentially inhibits both overarching mechanisms of AD pathology – inflammation and insulin resistance.

- Potentially inhibits proinflammatory pathways without impacting homeostasis.

BIV201 is the only drug currently in development for refractory ascites, a condition with 50% mortality rate. It has the potential to become first therapy since there are no approved drugs in the US

- BIV201 is a novel formulation of terlipressin for continuous infusion; Orphan and Fast Track designations received.

- Data from Europe/Asia supports development of BIV201; no drug-related SAEs in trials thus far.

- Initiating discussions with FDA for pivotal registration trial following encouraging data from Phase 2b study

- $1.6 billion global peak sales potential.

Upcoming catalysts

- Launch Parkinson’s Phase 2b trial late 2024 or early 2025

- Launch of Long COVID Phase 2 trial early 2025

- Launch next Alzheimer’s Phase 3 trial in late-2025 using new once-daily formulation of bezisterim

- Continue partnering conversations for bezisterim (geographic rights)

- Launch ascites Phase 3 when partner identified

Commercial Potential in US Market

Sign Up For BIVI Email News Alerts

Disclosure

RedChip Companies, Inc. research reports, company profiles, and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in RedChip reports, company profiles, or other investor relations materials and presentations are subject to change. RedChip Companies and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time.

RedChip Visibility is a division of RedChip Companies, Inc. and offers research services to paying clients. In the purview of Section 17(b) of the Securities Act of 1933 and in the interest of full disclosure, we call the reader's attention to the fact that RedChip Companies Inc. is an investor relations firm hired by certain companies to increase investor awareness to the small-cap equity community.

Stock market investing is inherently risky. RedChip Companies is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles, or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov and/or the Ontario Securities Commission (“OSC”) at www.osc.gov.on.ca.

BioVie (BIVI) is a client of RedChip Companies, Inc. BIVI agreed to pay RedChip Companies, Inc., a $7,500 monthly cash fee, beginning in March 2022, for 12 months of RedChip investor awareness services. The CEO of RedChip Companies owns 3,150 shares of BIVI. BIVI also agreed to pay RedChip a fifty-thousand dollar fee for a national TV ad campaign scheduled to air weekdays from June 17 through July 1, 2024.

Investor awareness services and programs are designed to help small-cap companies communicate their investment characteristics. RedChip investor awareness services include the preparation of a research profile(s), multimedia marketing, and other awareness services.