Terms and Agreement

Please agree to the terms to continue using the chat feature.

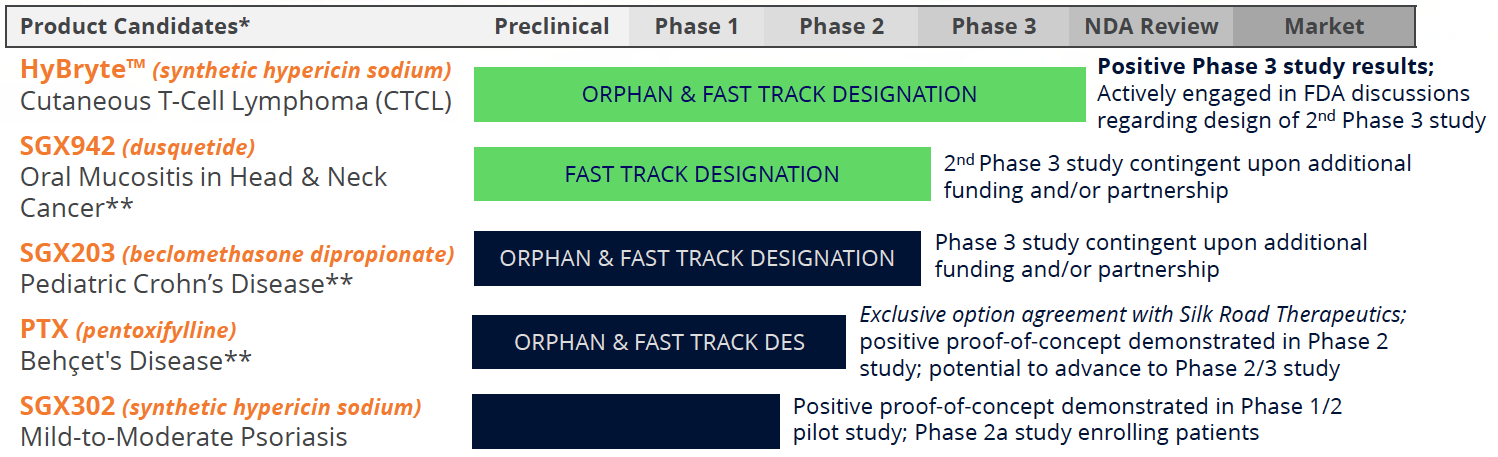

Soligenix is a late-stage biopharma company focused on developing and commercializing products to treat rare diseases where there is an unmet medical need. Its main business, Specialized BioTherapeutics, develops HyBryte™ (synthetic hypericin) for cutaneous T-cell lymphoma (CTCL). A Phase 3 study for HyBryte™ is complete and a confirmatory replication study is expected to begin by the end of 2024. HyBryte™ has received orphan drug and fast track designations from the FDA and orphan designation from the EMA. Soligenix is also evaluating synthetic hypericin (SGX302) for psoriasis with a Phase 2 study ongoing. Additionally, the company is advancing dusquetide (SGX942 and SGX945) for inflammatory diseases, including oral mucositis and Behçet's disease, with FDA "Fast Track" designation for the latter. A Phase 2 study with SGX945 in Behçet's disease is set to begin later this year.

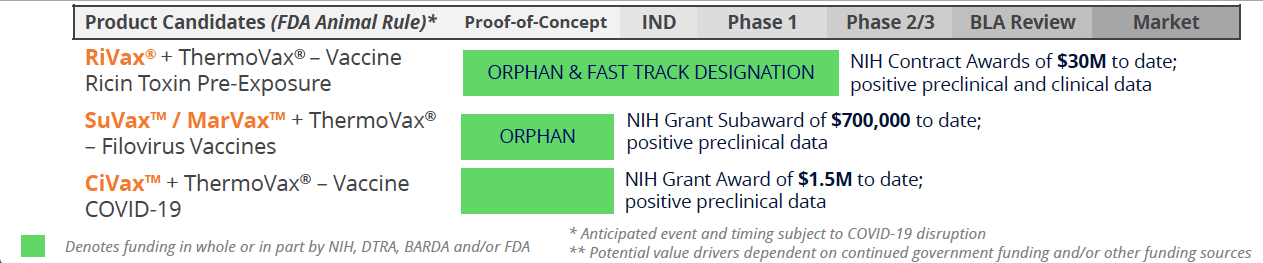

Soligenix’s Public Health Solutions segment develops products for severe medical conditions, such as the ricin toxin vaccine RiVax®, vaccines for Ebola (SuVax™) and Marburg (MarVax™), both granted orphan drug designation by the FDA. They are also developing a COVID-19 vaccine. All of these vaccines incorporate ThermoVax®, its heat stabilization platform. This segment is funded by agencies like NIAID, DTRA, and BARDA, with $60M+ in non-dilutive grant funding received to date.

Soligenix, a late-stage biopharmaceutical company, showcases a strong portfolio with several products in advanced clinical stages, targeting a potential $2 billion in annual global sales. Notable among these is HyBryte™, a photodynamic therapy for cutaneous T-cell lymphoma (CTCL), a rare chronic cancer, which has demonstrated positive results in a Phase 3 study published in JAMA Dermatology. The company is gearing up for a follow-up confirmatory Phase 3 study, with HyBryte's™ market potential estimated at $250 million. Additional promising assets include SGX302, aimed at treating psoriasis, currently in a Phase 2a trial with a market potential exceeding $1 billion, and SGX945 for Behçet's Disease, with a Phase 2a set to begin later this year.

Moreover, Soligenix has secured collaborations across biotech, academia, and government to advance its public health pipeline, highlighted by non-dilutive funding and NIH grants supporting vaccine development. Recently, impressive data from its filovirus vaccine program has been published, showing complete protection in non-human primates against certain deadly viruses, with the FDA granting orphan drug designations. These developments position Soligenix as a compelling investment opportunity, with a strategic focus on unmet medical needs, robust partnership backing, and multiple potential upside catalysts expected in the next 6-12 months and beyond.

Commercial Targets: Unmet Medical Needs in Oncology and Inflammation

Funded by Government: Medical Countermeasures for Civilian & Military Use

Red Chat is here to summarize the SEC filing data on SNGX

Please agree to the terms to continue using the chat feature.